When honest historians — if we have any such thing left in America — look back at the first 20 years of the U.S. Shale business, I have little doubt that two overriding themes to describe the industry will emerge: transformational and resilient.

To say that this industry has been transformational is to engage in rank, an almost comical understatement. Shale, as a business, has transformed the domestic and global oil and gas industry; it has transformed the economies of several states, including those of Texas, New Mexico, Pennsylvania and North Dakota; and it has transformed America’s balance of trade and domestic energy security picture.

As the new century dawned 20 years ago, natural gas prices were spiking into the realm of double-digits and the commodity itself was in short supply as the big, conventional resource plays of the 20th century were in decline, some on their last legs. Natural gas in America was in fact a scarce resource, one that had major users of it moving factories and jobs overseas and electricity providers looking to other fuel sources and subsidies for renewables to power the new plants needed to meet rising domestic electricity demand.

Major suppliers of natural gas were in the process of kicking off projects to build new facilities designed to import liquefied natural gas (LNG) from overseas in anticipation that America’s demand for such imports would continue to rise into perpetuity. Even as the development of North Texas’s Barnett Shale was in its early stages, no one really believed that enough producible shale gas lay underground in North America to ever become a significant part of the domestic energy picture.

The picture for domestic crude oil as the 20th century came to a close was not appreciably better. The industry had suffered through a major price bust from 1997 through 1999 and was just coming out of it when 2000 dawned. The decline of the major conventional fields had created the same shortage of domestic supply that existed where natural gas was concerned. Thus, while prices were in a healthier range, that did not mean U.S. drillers were any better able to meet the nation’s energy needs, or even a majority of them, as the country was importing well over half of its daily oil consumption.

The conventional wisdom of the day said that the U.S. oil and gas business was, in fact, in a state of permanent decline. All of the big plays, the narrative went, had been found and exploited, and it was all downhill from here.

Boy, was that wisdom wrong.

Now, fast-forward 20 years to today and, even in the wake of two major oil price busts in the last five years, we see a domestic energy picture that has been completely transformed thanks to the shale revolution:

- Natural gas is now so abundant in the U.S. that the conventional wisdom is that the low price picture seen over the past decade will continue into the foreseeable future;

- That long-term outlook for low natural gas prices has resulted in the return of billions of dollars of plant and infrastructure and hundreds of thousands of jobs in the chemical, fertilizer and plastics industries that had been shipped overseas from 1970 through 2000 back to the United States, with hundreds of billions in future investments already on the books;

- Natural gas-fired power plants have displaced so much coal-fired power over the past decade that U.S. carbon emissions have been lowered to levels not achieved since the early 1990s;

- Essentially all of the LNG import facilities built during the early 2000s have been converted to facilitate the export of U.S. natural gas to other nations, and the U.S. now ranks as the world’s third-largest exporter of LNG;

- We have seen a similar transition on the oil side, as U.S. production has more than tripled in the past dozen years, since the advent of the development of the Eagle Ford, Bakken and the Permian Basin;

- U.S. crude oil exports have been cut by 50% as a percentage of overall domestic consumption;

- U.S. shale oil production of light, sweet crude has overwhelmed the capacity of domestic refiners to process that grade of oil, leading to the establishment of a major new U.S. crude export business. The U.S. stands today as one of the half dozen largest exporting countries in the world;

- The addition of so much U.S. shale crude to the global market has led to chronically low oil prices to the great benefit of U.S. consumers who today enjoy historically low gasoline prices at the pump.

So, yes, “transformational” is a very appropriate word to use to describe the U.S. shale business.

With all of the transformation it has wrought over the past 20 years, the domestic shale business has also developed a high degree of resilience as companies have prospered and grown during the good times and devised strategies to survive during the downturns. As if the major price bust of 2014-2016 wasn’t bad enough, the industry has suffered the twin hits of COVID-19 and the Saudi-Russia price war during 2020 and yet continues to persevere.

Even as the price for West Texas Intermediate stalled near the $40 per barrel level beginning in August, we have seen the domestic rig count start to inexorably start rising again as companies develop strategies to get back to some semblance of business and maintain production levels that have dropped off by over a million barrels per day since March.

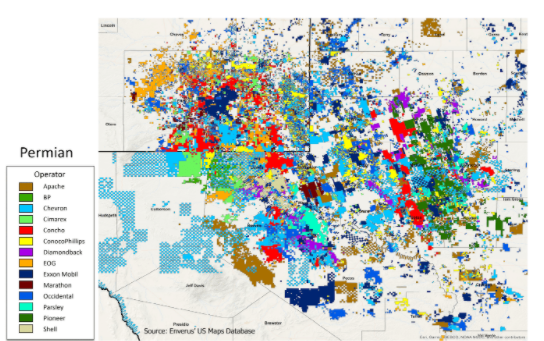

As the current price bust becomes increasingly drawn-out, the ability to take advantage of economies of scale has become more and more important in the shale patch. This has been especially true in the vast Permian Basin of West Texas and Southeast New Mexico, which has been the focus of a flurry of major buyouts and mergers, starting with Chevron’s acquisition of big independent producer Noble Energy in late July.

The Permian-centric deals continued into September with the merger of Devon Energy and WPX, and on into October, as ConocoPhillips announced its acquisition of Concho Resources and the planned merger between Pioneer Natural Resources and Parsley Energy, both former cover story subjects for SHALE Magazine.

If growing bigger really is better in the shale patch, then a plethora of big independents with quality acreage positions in the Permian and other major U.S. shale plays remain out there looking for possible suitors. You can see some of them and their acreage positions on this map prepared by Enverus:

Those companies that don’t end up being a part of a merger deal that would reduce costs through economies of scale and eliminating redundancies will continue developing innovative new processes and strategies to get to the other side of the current bust — because that is what the companies in this transformational and resilient business have always done.

About the author: David Blackmon is the Editor of SHALE Oil & Gas Business Magazine. He previously spent 37 years in the oil and natural gas industry in a variety of roles — the last 22 years engaging in public policy issues at the state and national levels. Contact David Blackmon at [email protected].