Here are 10 things you need to know about oil and gas for March 30, 2020:

Exxon May Crush Bailout Hopes for Suffering Fracking Companies – If you are hoping for the federal government to step in and implement polices that would save shale producers during this latest price crash, you are likely to be disappointed. It is very hard for the government to act when the industry is divided among itself.

U.S. Department of Energy ditches plans to buy oil for strategic reserve – As an example, what is clearly a good idea gets caught up in the confusion created by the industry itself.

Minnesota, Wisconsin frac sand mines crushed by oil industry shifts – Some of the nation’s biggest stand mines are being crushed by the rapid decrease in demand.

U.S. Stock Futures Falter as Oil Trades at 18-Year Low – The price for WTI dropped below $20/bbl in overnight Asian trading. Yikes.

Global oil refiners shut down as coronavirus destroys demand – In the oil and gas industry, everything flows downstream, including the pain. But the shutting down of refining capacity will also boomerang back upstream as producers will be forced to start shutting in wells as they lose the ability to find a refining home.

Natural-gas futures touch their lowest level in 25 years, but still outperform oil – Oil is not the only commodity suffering from low prices. Natural gas prices were already depressed before the coronavirus became a thing.

Women who call the shots in oil and gas – Now for a break from all the bad news: A very nice piece detailing women leaders in the oil and gas industry.

Rosneft pulls out of Venezuela over US sanctions – This move wasn’t only over the sanctions. The dramatic drop in oil prices also contributed to this decision by the giant Russian oil company.

The rig count dropped by 7%, week over week – According to the Daily Rig Count tallied by Enverus, the nation’s rig count fell by 60, from 786 to 726, from March 21 to March 28. Expect that trend to continue for the foreseeable future.

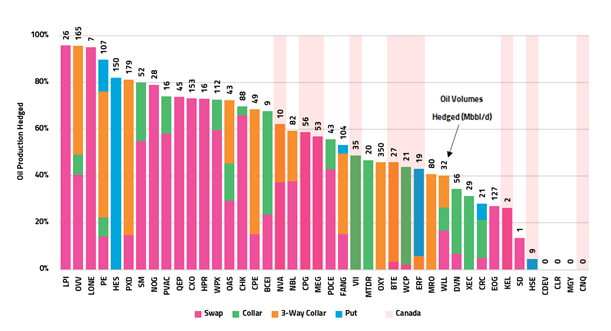

Let’s close with some data on hedges provided by the great folks at Enverus:

“The team’s latest analysis reveals 2.5 MMbbl/d of aggregate 2020 oil-hedge volume among publicly traded North American E&Ps at an effective hedge price above $50 WTI. Most oil-weighted E&Ps have hedged between 25% and 90% of anticipated oil production for the year. Enverus estimates the value of these financial-derivative assets (in conjunction with gas and NGL hedges) exceeds 10% of respective enterprise values for the majority of E&Ps.”

Estimated Oil Production Hedged in 2020

Source: Enverus

The bottom line here is that those companies with a large percentage of their equity production hedged at higher-than-market prices will be better equipped to survive this downturn for the rest of this year. But if it lasts into 2021, then all bets will be off.

That’s all for today.