The renewable energy snowball has begun to roll, and power sources like wind and solar are increasing rapidly. It’s hard not to notice if you have to pass one of those giant wind turbine blades being trucked along the highway.

In President Biden’s proposed budget, he has inserted a big chunk of money aimed at arresting climate change and including spurs for renewable energy. For example, the Energy Department would increase by about 10% overall, with $8 billion (an increase of 27%) directed at a new generation of electric vehicles, nuclear reactors and other alternatives to burning fossil fuels.

The cost of solar and wind generators has come down to 33% and 50% respectively since 2015, and the price of batteries for storing electricity has been halved in the past few years.

The case for using renewables to reduce greenhouse gases (GHG) in the atmosphere has received a lot of attention, with a goal to avoid the worst effects of global warming.

It’s not hard to see that renewables will increase over time and that fossil energies will decrease. The coal industry has been forced to accept this. But the oil and gas industry in the U.S., which has been particularly successful in their shale revolution the last 20 years, is reluctant. And understandably so, because they see profits falling and jobs going away.

This decline in oil and gas production — will it be slow or rapid? A gradual adjustment or a painful disruption? Some answers come by putting numbers on the U.S. greening of electricity and transportation, two of the largest users of oil and gas. The analysis is simplified but insightful.

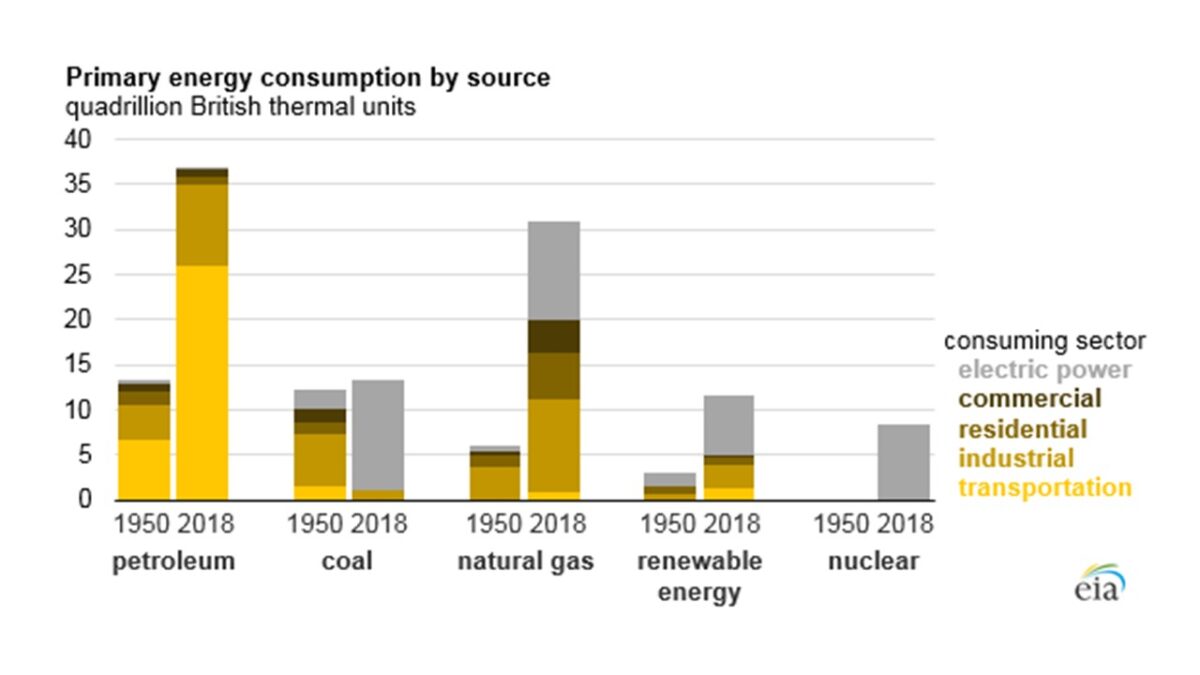

Let’s begin with fossil fuel consumption in the U.S. in the year 2018. Figure 1 compares this against renewables and nuclear. The approach is to look at goals for renewable increases (called greening) and convert these to fossil fuel decreases based on a zero-sum replacement in Figure 1.

Figure 1. US energy consumption by source and sector. Source: IEA.

Greening of transport

The transport sector works primarily off oil, which refineries convert into gasoline.

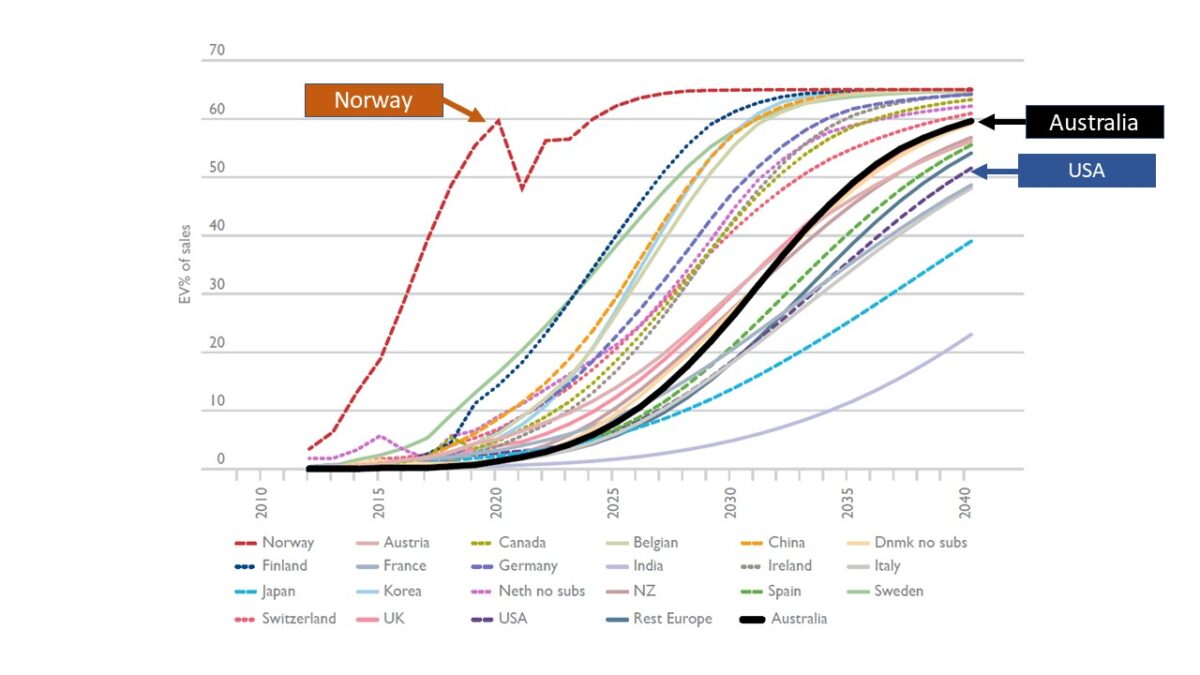

Cars and trucks are going green at a rapid rate in some countries. Norway leads the pack with 60% of electric vehicles in new car sales (Figure 2). The US lags seriously.

Volkswagen recently announced its dive into electrified vehicles (EV). The basic SRV, called ID.4, will be priced at $40,000 and have a range of 250 miles. Volkswagen’s target is a million EV sales in 2021. Apparently, they even plan to build their own charging stations across the U.S.

Figure 2. Projected uptake of electric vehicles as a percentage of sales by country.

Source: AUSTRALIAN GOVERNMENT, DEPARTMENT OF INFRASTRUCTURE, TRANSPORT, REGIONAL

DEVELOPMENT AND COMMUNICATIONS.

In the U.S., cars have started going electrical, but plug-ins are less than 2% of all U.S. cars on the road, and widespread adoption will be dubious if charging stations are not built quickly enough.

Figure 1 shows that oil usage in U.S. transportation was 26 quads in 2018. Biden’s goal is that new sales of EVs will be 50% of all sales by 2030. If this means about a third of all vehicles on the road are electric by 2040, then 26 quads of transportation petroleum (oil) will have declined by close to 9 quads.

Since total petroleum usage is 37 quads in Figure 1, this 9-quad decline implies a 24% decline in consumption of oil in the U.S. by 2030. But if industrial usage of petroleum also falls, as expected, the number would be greater than 24%.

If supply follows demand, then a 24% decline in oil production would be expected by 2030 — a quarter of oil production decline in only nine years.

If industrial consumption (8 quads) in Figure 1 also fell due to the transition to renewables, then total oil production could fall by more than 24%.

Renewables other than nuclear would have to increase by nine quads to replace this petroleum decline by 2030. Since from Figure 1, the base-case is 12 quads of renewables, a 9-quads increase to 21 quads represents a 75% increase. This may be feasible.

A similar analysis can be done for the greening of electricity, based on conversion of coal and gas-fired power plants to renewable sources of wind and solar. The goal is Biden’s changeover to 100% renewable electricity by 2035, which implies replacing 23 quads of coal and gas energy that results in a 32% drop in natural gas consumption by 2035 (Figure 1). If supply follows demand, then gas production could drop a third by 2035.

Caution: the total amount of new renewables would need to be 32 quads to replace the fossil energy reductions in these two sectors. Renewables would have to increase from eight quads in the base case (Figure 1) to 40 quads by 2035.

This would be an increase by five times which is such a massive number that it adds doubt to the goal of replacing all power plants with renewable electricity by 2035.

Consumer action will decide the transition timeline

For the U.S., this simple supply and demand picture suggests that if demand falls in electrical and transport sectors, then supply is likely to follow in the form of serious cuts to oil and gas production within 10-15 years.

Government policies can be federal or state regulations, as well as President Biden’s overarching goals. They can include price discounts or tax subsidies to lower the price of EVs enough that people have the means to purchase. Norway has succeeded in this — 60% of new cars are now EVs.

Proactive industries willing to take a chance on a new future will respond to government policy, such as GM and Volkswagen promising to manufacture only electric cars by a date soon after 2030.

Individual stakeholders can vote during annual conferences of energy companies, or they can initiate motions on the agenda to promote actions on climate change. This recently occurred in ExxonMobil.

Consumers can spread their individual influence in several ways:

- Buy an electric car, initially for city driving where home-charging is available. Or an electric truck such as the Tesla Electric Pickup Truck due in 2022 (and pre-orders have flown).

- Buy a rooftop solar system, with or without a large storage battery in case of external power failure. There are more rooftop solar systems in Australia (population 25 million) than in the USA (population 325 million).

- Conserve power usage in cars, homes and workplaces. Convoy to work, buy a smaller home, turn the thermostat down, don’t leave lights on.

- Minimize plastic usage, as plastics come from ethane and propane that are produced by shale wells.

All of the above initiatives will need to be adopted. They have all begun, and the transition snowball is rolling. The fourth initiative, consumer action, will decide how quickly and how deeply the changes will occur. The oil company, BP, in its “Energy Outlook 2020,” has included a scenario for when the most rapid changes occur — and it’s based on a large fraction of consumers across the world actively adopting changes such as mentioned above.

There are caveats. First, the growth of world population and need for extra energy is not considered, even though this could be substantial through 2035, the timeline considered here.

Second, the federal government goals may not be met by the ordained dates. But support is growing when the federal government raises climate change to a “crisis” stature in the cabinet, and a new groundswell for climate action is expanding amongst the U.S. population. Still, to achieve the government goals discussed above will likely require a carbon-pricing mechanism.

It might be wise for oil and gas companies to adopt a proactive stance and see what changes could be made in their business, as uncomfortable as that might be. The way forward might be for oil and gas companies to diversify into renewable energies. It seems a straightforward way to gain — instead of eventually losing — many customers.

About the Author: A petroleum engineer and consultant, Ian Palmer, PhD has worked at Los Alamos, The Department of Energy, BP, and Higgs-Palmer Technologies. He is a contributor at Forbes.com and the author of The Shale Controversy.