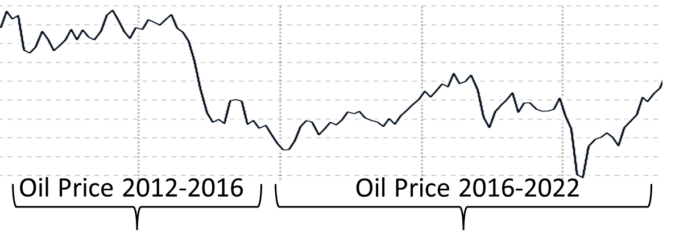

We have learned from past downturns that exploration and production (E&P) companies and oilfield services and equipment (OFSE) companies are most at risk of downturn commodity prices. Compounding the risk, OFSE companies are further affected by the intrinsic volatility and bullwhip effect of their customers’ dynamic buying behaviors.

With oil prices now stabilized around $60-$70 a barrel, many large E&P companies, seeking high levels of free cash flow, are re-shuffling their portfolios to lower breakeven prices. To achieve these high margins, E&P companies are working to better understand their value chain and trying to stitch together an ecosystem of expertise Integration and Value Creation, which helps them to create models that balance risks and rewards. OFSE companies have responded by integrating value chain and bundled offerings to lower customer costs. We are now seeing value-driven offerings in the form of operational, technical, and commercial Integration and Value Creationin workflows and integrated multi-business line contracts that push the ownership on OFSEs to bring a performance-driven mindset. These new service models are intended to drive business process efficiencies by collaborating with customers at the start of a project to optimize workflow procedures.

OFSEs have historically been a solution-driven industry. These companies grow by developing proprietary technologies and process know-how that can be applied across particular projects and which then become an industry norm and way of operating. The repeated use of these technologies and/or processes allows them to achieve economies of scale on both technology development and Integration and Value Creation. Now, with operators wanting a one-stop-shop for their entire well construction and production processes, large service companies are able to offer lump-sum services for all operations at the well site by expanding their existing workflow and filling gaps in their portfolio through mergers and acquisitions.

Vertical Integration and Value Creation is achieved by combining drilling, measurements, fluids, cementing and logging services in a single well construction and production process within one company, as opposed to a traditional process in which each step is handled by separate, unique providers. In the latter model, services and equipment are outsourced to many providers who each specialize in one or a few customized areas. The theory behind vertical integration posits that instead of paying several companies to handle activities directly related to your business production, a single company could extend its coverage and produce (or serve) more activities. In other words, you stop outsourcing and take everything in-house, expanding your service lines as necessary.

Traditional, discrete services in the current environment

In past decades, especially in deepwater environments, the OFSEs’ offering was based on discrete services and equipment capabilities. Operators exercised their choice of vendor by evaluating technology, expertise, and, most importantly, price. While this gave the operators leverage, it also meant having to manage multiple suppliers and drive synergies. This simultaneously increased costs and contributed to a loss of focus on efficiency and innovation in business processes and workflow. For a time, higher oil prices papered over these cracks, but in the current environment, they have re-surfaced as deeper and wider problems.

A typical example is in non-drilling times on a typical deepwater well, such as those required for pipe connections, tripping in, pressure testing, etc. These activities may have contributed to 70% of the well construction activity, yet this is not the typical area of optimization that operators and OFSEs were focused on. But with recent oil price pressures, both operators and OFSEs are looking at ways to reduce the cycle time for a well through full integration and data-driven decisions.

Today’s operators are increasingly challenged by the depletion of conventional low-cost reserves, confronting frontier oil and gas (O&G) projects, and development choices during tertiary recovery. As projects grow more complex and costly, operators need more technical and operations capability. They are responsible for selecting and integrating technologies and also optimizing and operating the project in its entirety. In order to do this, operators must put in place stringent qualification and validation criteria for all the discrete services and products.

Core business models focused on output-based models have resulted in a gross imbalance of value, which means that operators benefitted when an efficient well was drilled, but OFSEs benefitted by inefficiency. In other words, more time on the job means higher fees for the OFSEs. Along with the value conflict of interest, there is also a big difference in the scale of risk for an operator vs. a service provider. An operator drives its value by undertaking a risk-reward approach that shows its willingness to put in large amounts of capital to safeguard these risks. The service company drives value by promising greater value through its investment in technical research and delivering on agreed criteria in the contract, albeit without a performance incentive.

Integration and value creation

Learning from other industries such as healthcare, airlines, e-commerce, and tech, OFSEs are now getting more involved in value creation by bundling their offerings. This strategy helps them to have better control over the upstream value chain and to also move away from commoditizing their technology. With the bundling of offers from service companies, operators are able to reduce their spending through cost discounts and performance synergies. On the other side, service companies by expanding their footprint (revenue) on well construction and production drive new synergies across technology, the operating envelope, and commercial models. This mutual value creation is a classic example of growing the pie rather than splitting it up. The end-to-end integration of various services is achieved through the following steps:

-

Aligned commercial model:

The process of integration starts very early to negotiate an outcome-based incentive rather than one based on output. This model drives alignment and partnership between operators and OFSEs by linking their financial goals. Both parties now have an incentive to innovate, drive efficiency, and reduce cost. The OFSE provider has to plan and contribute its resources to deliver the customer’s desired outcome and thus has skin in the game to share the risk.

2. Integrated approach to risk management:

As the saying goes, “Corporations make money by taking risks and lose money by not effectively managing risk.” A typical approach to risk management assessment on discrete services is performed in isolation and considered more of a planning exercise rather than analyzing it for the lifecycle of a project. Furthermore, this approach does not consider the impact of change, and the risks change introduces in other parts of the operations. An integrated approach to risk management brings a holistic approach throughout the lifecycle of the project. This process unites all the stakeholders from the operator and the OFSE company in performing a detailed risk identification exercise that involves all the subject matter experts. With a common repository created for the entire well construction process, these risks and their mitigation plan are referred to throughout the execution cycle, aiding significantly in real-time data-driven decision making.

3. Integrating technology and business processes to reduce cost:

During the heydays of the O&G industry, OFSEs prioritized the use of technology for outcome efficiency, and this drove capital efficiency and growth. Because the technologies were focused on improving operations and facilitating growth while oil prices were high, costs were not the most important consideration. Conversely, in the current environment, the need to lower costs have taken precedence. An example of this is the use of drilling automation, with value propositions for existing technologies tied directly to cost reduction. The improvement of connectivity and high-speed internet, even at frontier locations, has allowed for the automation of many tasks, which can then be moved away from the wellsite. Business process improvement has now been offered to the customers as part of their technology portfolio to lower the operators’ cost. These processes include lean methodologies applied to the well construction and project management processes, data analytics to optimize operations, and others.

Digital Innovation and Culture Change in the OFSE Industry:

Digital innovation is further transforming this landscape through end-to-end integration. For example, increasing analytical capabilities to identify subsurface uncertainties facilitates faster, data-driven decision-making that has enabled OFSEs to generate significant value.

In O&G, the pre-pandemic and post-pandemic worlds are going to be completely different. OFSEs are using this opportunity to change the current paradigm. Integration, in combination with digital transformation, will provide a solution going forward that will enable the next cycle of growth, although integrated offerings have brought a major shift in the way OFSEs and operators are conducting business. This has some intrinsic benefits which will help to differentiate them from their competition:

- Culture Change: An aligned operating and commercial model have a significant cultural impact on both organizations, as they are now working organically together in a partnership, rather than in the former customer-vendor relationship. This has helped OFSEs to improve their customer experience and ease of doing business. The culture of collaborating for solutions (replacing the “it’s not our problem” singular view) is slowly beginning from both sides of the organization. A lesson on changing human behavior can be learned once contributing factors (incentives) are tweaked.

- Talent Attraction: Integrating operations with new digital technologies have enabled the OFSE industry to once again be attractive to new talent. Digital automation and multi-skilling are making OFSE companies the employer destination of choice for top talent in areas such as digital, technology and commercial.

Conclusion

Integration and Value Creation operations with technical and commercial aspects will be critical. A number of oil and gas companies have already set net-zero-emissions targets, and to empower this transition, operators and OFSEs will have to work together by integrating their value chain: first, to build a resilient and sustainable core hydrocarbon business, and second, to develop a new operating model that will succeed in low-carbon environment.