Permian pipeline connections are beginning to bottleneck, as revealed by Kayrros data. The bottleneck is caused by the pipeline capacity reaching saturation, limiting the flow of oil to storage hubs, which comes at a time when Kayrros sees the output from the basin rising in August 2018. Price differentials are set to widen until the entry of service of the Permian to Corpus pipeline in mid-2019.

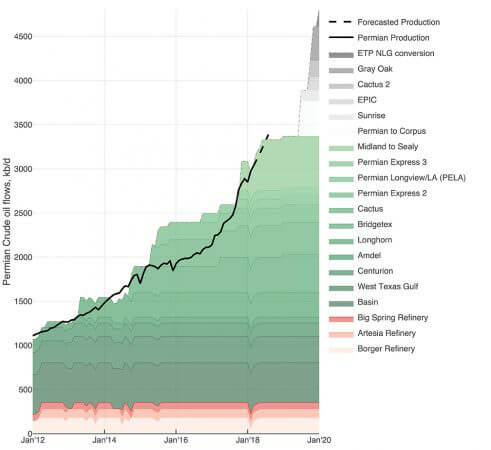

Kayrros sees Permian production growing steadily on average in each of the four coming months, reaching a new height in August.

As production grows over the coming months, it will surpass total pipeline and refinery capacity by July 2018. This means the excess supply will have to be transported by rail or truck.

Kayrros estimates the saturated pipeline capacity is likely to remain that way for the next 12 months.

Although the Midland-to-Sealy pipeline recently began full service, the rate of growth in production is expected to surpass total pipeline and refinery capacity still. The 40 thousand barrels per day (kb/d) expansion of the BridgeTex pipeline, expected to be operational early 2019, is unlikely to meet the increased demand.

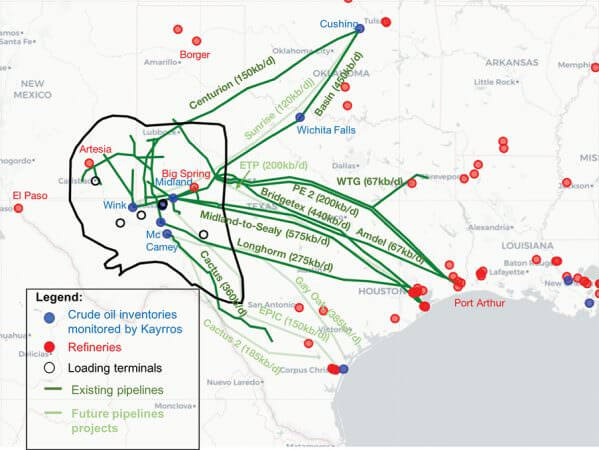

The next major project to come on-line is the 400 kb/d EPIC pipeline linking the Permian Basin to Corpus Christi, Texas, but it will not be available before the third quarter in 2019.

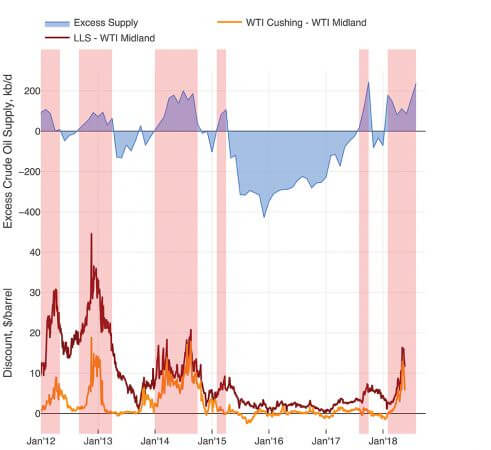

The spread between WTI Midland (WTM) and Louisiana Light Sweet (LLS) increased to a three-year high of $16.45 a barrel as of May 4 and remained above $14 for three weeks.

The last extended period of saturated pipeline capacity dates to January 2014 and lasted for 10 months before the first lines of BridgeTex pipeline entered service, adding 300 kb/d of takeaway capacity at the time.

The LSS-WTM spread hovered around $10 a barrel during that period, while the WTM discount to WTI Cushing (WTC) reached a high of $17.25 a barrel July 2014.

The recent restart of the crude distillation unit at the Borger refinery as well as the full entry into service of Midland-to-Sealy pipeline brought some relief to the saturated takeaway capacity, narrowing the WTM/LLS spread down to $11.35 a barrel May 22.

During the previous period of saturated pipeline capacity between January and October 2014, truck movement of crude in the basin soared, with up to 750 kb/d of crude transported on Texas roads in October (+95 kb/d compared to January of the same year). Crude movements by rail also increased to 65 kb/d September 2014, from a low of 4 kb/d December 2013.

With current estimates for rail costs varying between $6 to $8 a barrel and trucks amounting to three times the rail costs, recent spreads have followed traders’ initiatives to arrange for rail and truck transportation out of the Permian. Any trucking shortage is set to push price differentials to new highs.

Forecasted production (dashed black curve) considers both the reporting lag estimate for the last three months and future production for the next three months. Refinery capacity (in red) for local refineries considers the reported outages of these refineries.

Excess supply is defined as the difference between Permian production and the takeaway capacity of the basin aggregating pipelines and the local refineries, as specified in Figure 2. Shaded areas in red are associated with positive excess supply.

For more information: Kayrros delivers insights on the global energy market to help players make better investment decisions, using advanced data analytics and cutting-edge technologies such as machine learning and AI. Kayrros experts process and analyze data from multiple sources that include satellite imagery and maritime signals to provide its customers with market forecasts and near real-time measurements of key global energy trends. Kayrros teams are based in Paris, New York, Houston, San Francisco and Singapore to deliver actionable information in near real time and with less delay than existing publicly available sources. Through its unique combination of data analytics, machine learning, and expert insight, Kayrros helps provide greater transparency to the traditionally opaque energy sector. For more information, please visit www.kayrros.com.

All figures in this article sourced from Kayrros, EIA, Thomson Reuters, and RBN Energy