Occidental lobs in a formal $57 billion bid for Anadarko

Analysis by DrillingInfo

Occidental has formally announced a $57 billion bid for Anadarko, coming in over the top of Chevron’s $50 billion offer made two weeks ago. The announcement confirms rumors of an Oxy bid that were circulating when the Chevon deal was announced.

The offer of $76/share (50% equity, 50% cash) represents a ~17% premium to Chevron’s $65/share bid using prices at announcement and a 20% premium using closing prices as of April 23. “It is rare to see a competitor come out publicly with a competing bid once a deal is announced, and we think this move by Occidental speaks to the quality of Anadarko’s asset base,” said Drillinginfo M&A analyst Andrew Dittmar. “This deal will set a new and important benchmark for future transactions.

Those looking to acquire other Permian-centric E&Ps are probably disconcerted to see the competition intensify in the form of aggressive counter offers.” If accepted, the Oxy bid would jump over BP/Amoco to become the fourth-largest upstream oil & gas deal in history before any inflation adjustment.

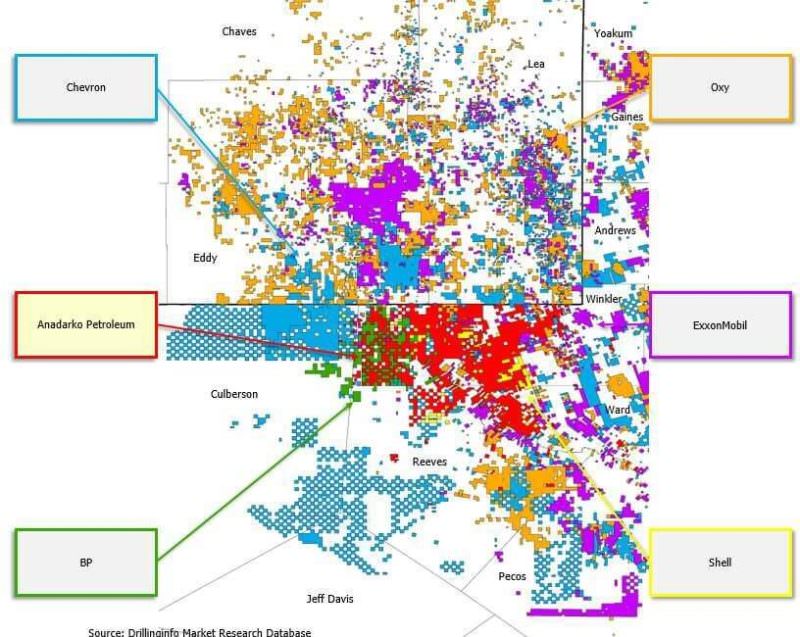

“The Permian is clearly the primary driver of this competition between Chevron and Occidental for Anadarko. Occidental and Chevron are already the top two producers in the Permian, and whichever comes out on top in the struggle for Anadarko will claim the top spot. Anadarko also brings to the table some of the best undrilled well locations in the basin. For the increased Oxy bid of $57 billion, we are raising the value allocated to Permian acreage up to nearly $20 billion or ~$80,000 per acre,” Dittmar added.

Delaware Basin Strategic Acreage Positions

Beyond the Permian, Occidental gets just under 40% of its output from the Middle East fitting Anadarko’s operations there, while Anadarko’s Gulf of Mexico and LNG assets are perhaps less of an obvious fit than in the Chevron portfolio.

“Wall Street is now expecting Anadarko to receive a premium from the Chevron offer trading up 11% while Occidental is down a slight 3%,” added Dittmar. “Anadarko shareholders will have to consider not only the bid mechanics and amounts but also the future value of equity from Chevron or Occidental. In not engaging with Occidental’s earlier, higher bids, Anadarko was implicitly signaling that they perceive higher potential value in Chevron’s equity likely in part because of Chevron’s Gulf of Mexico and LNG experience.”